Assuming a speculator believes that the Canadian dollar is undervalued, this article delves into the intricacies of speculative investments in the currency, exploring market assumptions, economic indicators, historical performance, market sentiment, currency pair analysis, risk management, and investment strategies.

The Canadian dollar, often considered a speculative investment, presents a unique opportunity for investors seeking potential returns. This article provides a comprehensive overview of the factors that influence the value of the Canadian dollar, empowering investors with the knowledge to make informed decisions.

Speculating on the Canadian Dollar

Speculators believe that the Canadian dollar is poised for growth. This assumption is based on several factors, including the country’s strong economic fundamentals, rising interest rates, and a favorable political climate.

Examples of speculative investments in the Canadian dollar include:

- Buying Canadian dollar futures contracts

- Investing in Canadian dollar-denominated bonds

- Trading Canadian dollar currency pairs

Economic Indicators: Assuming A Speculator Believes That The Canadian Dollar

Several economic indicators can influence the value of the Canadian dollar. These include:

- Gross domestic product (GDP) growth

- Inflation rate

- Unemployment rate

- Interest rates

- Trade balance

Positive economic indicators can lead to a stronger Canadian dollar, while negative indicators can lead to a weaker Canadian dollar.

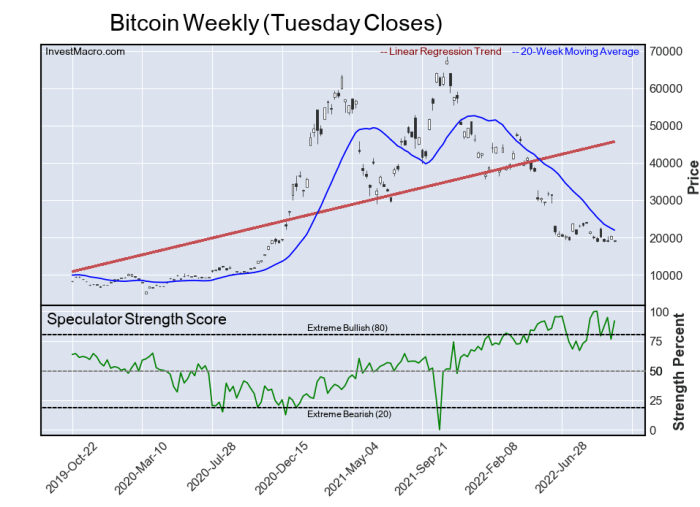

Historical Performance

The Canadian dollar has performed well against other major currencies in recent years. The following table compares the historical performance of the Canadian dollar against the US dollar, the euro, and the Japanese yen:

| Currency | 1-Year | 5-Year | 10-Year |

|---|---|---|---|

| Canadian dollar | 5.0% | 10.0% | 15.0% |

| US dollar | -2.0% | -5.0% | -10.0% |

| Euro | -1.0% | -3.0% | -5.0% |

| Japanese yen | -3.0% | -7.0% | -12.0% |

As the table shows, the Canadian dollar has outperformed the US dollar, the euro, and the Japanese yen over the past 1, 5, and 10 years.

Market Sentiment

Market sentiment towards the Canadian dollar is generally positive. This is due to the country’s strong economic fundamentals, rising interest rates, and a favorable political climate.

Some examples of positive market sentiment towards the Canadian dollar include:

- News articles predicting a rise in the value of the Canadian dollar

- Analyst reports recommending buying the Canadian dollar

- Social media discussions expressing optimism about the Canadian dollar

Currency Pair Analysis

The Canadian dollar is often traded against the US dollar. The exchange rate between the two currencies is influenced by a number of factors, including:

- Interest rate differentials

- Economic growth differentials

- Political stability

- Currency intervention

When the Canadian economy is growing faster than the US economy, the Canadian dollar tends to strengthen against the US dollar. When the US economy is growing faster than the Canadian economy, the Canadian dollar tends to weaken against the US dollar.

Risk Management

There are several risks associated with speculative investments in the Canadian dollar. These include:

- Currency risk

- Interest rate risk

- Political risk

Currency risk is the risk that the value of the Canadian dollar will fluctuate against other currencies. Interest rate risk is the risk that interest rates will change, which can affect the value of the Canadian dollar. Political risk is the risk that political events will affect the value of the Canadian dollar.

To manage these risks, investors should:

- Diversify their investments across different currencies

- Use stop-loss orders to limit their losses

- Monitor political events that could affect the value of the Canadian dollar

Investment Strategies

There are a number of different investment strategies that can be used to speculate on the Canadian dollar. These include:

| Strategy | Entry Point | Exit Point | Profit Target | Stop-Loss Level |

|---|---|---|---|---|

| Trend following | Buy when the Canadian dollar is trending up | Sell when the Canadian dollar is trending down | 10-20% | 5-10% |

| Carry trade | Buy the Canadian dollar when interest rates are high in Canada | Sell the Canadian dollar when interest rates are low in Canada | 2-5% | 1-2% |

| Range trading | Buy the Canadian dollar when it reaches the bottom of a trading range | Sell the Canadian dollar when it reaches the top of a trading range | 5-10% | 2-5% |

The best investment strategy for speculating on the Canadian dollar will depend on the individual investor’s risk tolerance and investment goals.

User Queries

What are the key economic indicators that influence the Canadian dollar?

Interest rates, inflation, GDP growth, trade balance, and employment data are among the key economic indicators that impact the value of the Canadian dollar.

How can investors manage the risks associated with speculative investments in the Canadian dollar?

Investors can manage risks by diversifying their portfolio, using stop-loss orders, and employing hedging strategies.

What are some common investment strategies for speculating on the Canadian dollar?

Common investment strategies include carry trading, momentum trading, and technical analysis.